The latest research carried out by Unioncamere showed that in the second quarter of 2020 alone, the registrations of new businesses led by women were more than 10 thousand less than in the same period of 2019. This decrease, equal to -42.3%, is higher than that recorded by male activities (-35.2%).

The difficulties triggered by the health emergency have hit the female business world more sensitive to the economic cycle than the male one: 21% of female businesses believe they are more exposed to the negative trend of the economy compared to 18% of male businesses. After the stagnation at the beginning of 2020, the number of employees also registered a sharp drop, which mainly affected the female component. The main causes seem to be: a greater vulnerability of women in the labor market, more employment in the sectors most affected by the pandemic and, finally, a greater burden in family management [1].

“In a context of general emergency that has affected the most diverse sectors, we are witnessing a negative trend in particular on employment and female entrepreneurship. For this reason, we want to be part of the solution, supporting women’s businesses and all businesses that offer services to families. Because a fairer and more inclusive society that values women’s skills and professionalism can generate more growth and well-being for all,” said Roberta Marracino, Head of Group ESG Strategy & Impact Banking at UniCredit.

Against this backdrop, UniCredit is providing concrete support for:

- women entrepreneurs who want to start a new business or who want to grow it. They are offered inclusive and discounted financing, such as microcredit up to 50,000 euros, the support of a network of social partners and access to digital tools useful for business start-ups and financial planning. Finally, they are also provided with a skills support thanks to UniGens, the association of employees and former UniCredit employees, to give solidity to the growth of their businesses.

- profit and nonprofit companies that provide welfare, health and educational services, able to generate a concrete and measurable social impact. Also included are those projects and corporate initiatives that promote welfare services for their employees and their families. They are offered financing with a social impact for over 50 thousand euro at advantageous conditions. Upon achievement of the social objectives, the proposal is completed with the recognition of a donation of up to 20 thousand euros, a training program, the sharing of a network to spread the experiences and, finally, external visibility.

More information at www.unicredit.it/it/chi-siamo/noi-e-il-sociale/social-impact-banking/Ilvaloredelledonne.html

Note 1: Source: IV Female Entrepreneurship Report 2020, Unioncamere elaborations, Istat Annual Report 2020.

Popular

A New Impact Era: the GSG Leadership Meeting in… 14 April 2022

A New Impact Era: the GSG Leadership Meeting in… 14 April 2022  Young Challengers Program 2022 7 July 2022

Young Challengers Program 2022 7 July 2022  Turin chosen to host Cities Forum 2023 26 April 2022

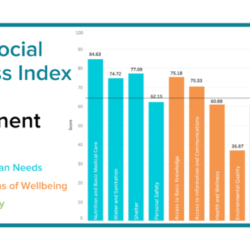

Turin chosen to host Cities Forum 2023 26 April 2022  Announced the 2020 Social Progress Index 6 October 2020

Announced the 2020 Social Progress Index 6 October 2020  The GSG Leadership Meeting arrives in Turin! 1 March 2022

The GSG Leadership Meeting arrives in Turin! 1 March 2022