An important addition to the Steering Committee of the Social Impact Exchange, established in 2021 and open to the participation and involvement of interested stakeholders, chaired by Guido Bolatto, Secretary-General of the Chamber of Commerce of Turin

Cassa Depositi e Prestiti (CDP) joins the current 24 members of the Steering Committee in the evaluation phase of possible scenarios for the creation of the market infrastructure. Given its mission to support innovation and competitiveness in the Italian business world and promote sustainable development of the country’s economy, CDP brings crucial expertise and tools to the Committee to effectively address the future challenges of the initiative.

The Social Impact Exchange is an innovative project developed by Torino Social Impact with the support of founding members (Chamber of Commerce of Turin, Compagnia di San Paolo Foundation, and Banca d’Italia). It aims to create a capital market dedicated to companies intentionally producing additional, measurable positive social impact. Transactions on this market are based not only on financial value but also on the measured value of social impact.

“The ultimate goal is to create a market reserved for companies that want to contribute to solving ever-growing social and environmental challenges, not just with brilliant ESG profiles but with business models that formally and consistently define sustainability as a foundational element of their mission,” stated Guido Bolatto, Chairman of the Steering Committee of the Social Impact Exchange “The entry of an actor like Cassa Depositi e Prestiti into the Committee is further evidence of how innovative and strategic this project is on the road to an impact economy”.

The Social Impact Exchange proposal complements existing financing channels, offering additional opportunities for those interested in supporting a “new” economy. This economy aims not only to mitigate negative environmental and social impacts but also to generate social value for all stakeholders.

In 2023, the simulated listing of 8 pilot companies concluded, involving 130 professionals to promote impact investing and create a capital market dedicated to impact enterprises. During the experimentation, companies worked on listing hypotheses on both stock and bond markets. Impact strategies and measurement methodologies were defined with a tailor-made approach to represent the specificities of each company. Engineered hypotheses of financial instruments were developed to predict mechanisms for valuing the achievement of impact results. The outcomes of the simulation are documented in a publicly available report on the initiative’s website.

Attività –

Popular

A New Impact Era: the GSG Leadership Meeting in… 14 April 2022

A New Impact Era: the GSG Leadership Meeting in… 14 April 2022  Young Challengers Program 2022 7 July 2022

Young Challengers Program 2022 7 July 2022  Turin chosen to host Cities Forum 2023 26 April 2022

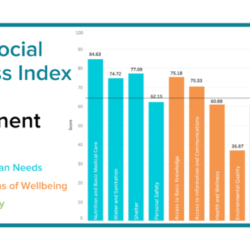

Turin chosen to host Cities Forum 2023 26 April 2022  Announced the 2020 Social Progress Index 6 October 2020

Announced the 2020 Social Progress Index 6 October 2020  The GSG Leadership Meeting arrives in Turin! 1 March 2022

The GSG Leadership Meeting arrives in Turin! 1 March 2022